Original from: PR Newswire

· Core Illumina revenue of $1.06 billion for Q1 2024, down 2% from Q1 2023 (down 2% on a constant currency basis)

· Core Illumina GAAP operating margin of 11.0% and non-GAAP operating margin of 20.6% for Q1 2024

· Reiterating fiscal year 2024 Core Illumina revenue guidance that is approximately flat compared to 2023 and a Core Illumina non-GAAP operating margin for fiscal year 2024 of approximately 20%

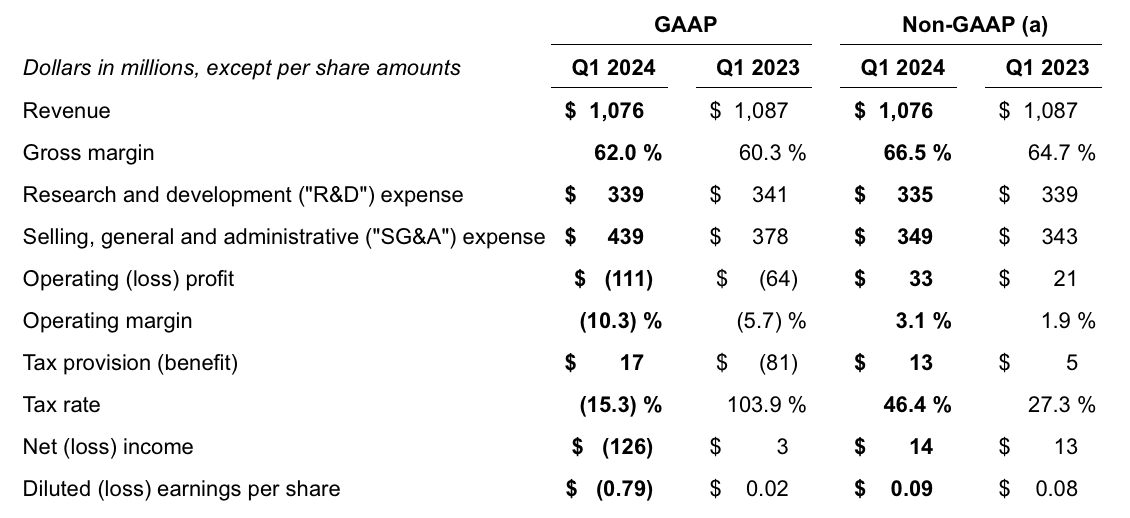

· Consolidated revenue of $1.08 billion for Q1 2024, down 1% from Q1 2023 (down 1% on a constant currency basis)

· GAAP diluted loss per share of ($0.79) for Q1 2024, compared to GAAP diluted earnings per share of $0.02 for Q1 2023

· Non-GAAP diluted earnings per share of $0.09 for Q1 2024, compared to non-GAAP diluted earnings per share of $0.08 in Q1 2023

· Illumina remains on track to divest GRAIL through either a sale or a capital markets transaction, with the goal of finalizing the terms of divestiture by the end of Q2 2024. In April, Illumina received approval of its divestment plan from the European Commission. In the instance of a capital markets transaction, the divestment plan requires Illumina to provide GRAIL with approximately $1 billion in funding

Illumina, Inc. (Nasdaq: ILMN) ("Illumina" or the "company") today announced its financial results for the first quarter of fiscal year 2024, which include the consolidated financial results for GRAIL.

"The Illumina team delivered results ahead of our expectations by supporting our customers with innovative solutions that enable the next wave of progress in genomics and multiomics," said Jacob Thaysen, Chief Executive Officer. "Our customers are leveraging the NovaSeq X to drive increased sequencing activity, even in a persistently challenging global macroeconomic environment. Additionally, our team's strong execution and continued focus on operational excellence enabled us to deliver year-over-year improvement in both gross margin and non-GAAP operating margin."

First quarter consolidated results

Capital expenditures for free cash flow purposes were $36 million for Q1 2024. Cash flow provided by operations was $77 million, compared to cash flow provided by operations of $10 million in the prior year period. Free cash flow (cash flow provided by operations less capital expenditures) was $41 million for the quarter, compared to $(42) million in the prior year period. Depreciation and amortization expenses were $108 million for Q1 2024. At the close of the quarter, the company held $1,115 million in cash, cash equivalents and short-term investments.

Key announcements by Illumina since Illumina's last earnings release

· Released XLEAP-SBS chemistry on NextSeq™ 1000 and NextSeq 2000 Systems, our fastest, highest quality, and most robust sequencing by synthesis (SBS) chemistry to date

· Launched Illumina Complete Long Reads (ICLR) with Enrichment, a flexible, cost-effective solution to enhance coverage of known challenging-to-map regions with targeted long reads where they provide the most value

· A recent literature review, published in the Nature journal Genomic Medicine, showed that short-read genomic sequencing (GS) reduces the time it takes to diagnose and treat pediatric patients who may have a rare genetic condition

· Appointed Ankur Dhingra as Chief Financial Officer and Jakob Wedel as Chief Strategy and Corporate Development Officer

· Appointed Jenny Zheng as Head of Region, Greater China

Key announcements by GRAIL since Illumina's last earnings release

· Presented new data at the American Association for Cancer Research (AACR) Annual Meeting that:

- Demonstrated the first real-world evaluation of repeat multi-cancer early detection (MCED) / Galleri testing showing the potential value of adding repeat MCED screening

- Exhibited 4-year overall survival follow-up demonstrating the prognostic significance of detecting cancer with a methylation-based cfDNA platform like Galleri

- Illustrated data demonstrating the power of Galleri to preferentially detect high grade, clinically significant prostate cancer over indolent cases.

· Announced a collaboration with AstraZeneca in which participants from Japan will have their samples tested using GRAIL's novel risk classification test on its Methylation Platform

Financial outlook and guidance

For fiscal year 2024, the company continues to expect Core Illumina revenue to be approximately flat compared to fiscal year 2023 and Core Illumina non-GAAP operating margin to be approximately 20%. While Illumina continues to move as quickly as possible to resolve GRAIL, the company is focusing its financial outlook on Core Illumina, as the specific timing and impact of the GRAIL divestment remains uncertain.

The company provides forward-looking guidance on a non-GAAP basis. The company is unable to provide a reconciliation of forward-looking non-GAAP financial measures to the most directly comparable GAAP reported financial measures because it is unable to predict with reasonable certainty the financial impact of items such as acquisition-related expenses, gains and losses from our strategic investments, fair value adjustments related to contingent consideration and contingent value rights, potential future asset impairments, restructuring activities, and the ultimate outcome of pending litigation without unreasonable effort. These items are uncertain, inherently difficult to predict, depend on various factors, and could have a material impact on GAAP reported results for the guidance period. For the same reasons, the company is unable to address the significance of the unavailable information, which could be material to future results.

Source: Illumina Reports Financial Results for First Quarter of Fiscal Year 2024

Copyright © 2026 GL events Ruihe (Shanghai) Exhibition Co., Ltd. All Rights Reserved. ( 沪ICP备12004745号-1 )

We deliver the latest IVD news straight to your inbox. Stay in touch with CACLP News.

sign-up for our newsletter today.

To ensure our newsletter hit your inbox, make sure to add @caclp.com to your safe senders list. And, as always, feel free to contact

us with any questions and thanks again for subscribing.

Go back

Go back