Original from: Siemens Healthineers

Siemens Healthineers AG today announces its results for the fourth quarter of fiscal year 2024 ended September 30, 2024, and the full fiscal year 2024.

Fiscal Year 2024 – Targets achieved for revenue growth and earnings per share

· Very good equipment book-to-bill ratio of 1.11; continued expansion of order backlog

· Comparable revenue growth of 4.7% despite current difficult market conditions in China; excluding the rapid COVID-19 antigen-test business, which ended in the prior year, comparable revenue growth of 5.2%

· Adjusted EBIT margin of 15.7%, 0.7 percentage points above prior year; adjusted EBIT rose to €3.5 billion

· Adjusted basic earnings per share of €2.23

· Free cash flow of around €2.1 billion clearly above prior year

· Proposed dividend of €0.95 per share, unchanged from prior year

Q4 Fiscal Year 2024 – Marked revenue growth at Imaging, Varian and Advanced Therapies

· Very good equipment book-to-bill ratio of 1.12

· Comparable revenue growth of 5.6%; excluding the rapid COVID-19 antigen-test business, which ended in the prior-year quarter, comparable revenue growth of 6.5%

· Imaging comparable revenue growth of 7.7%, very good adjusted EBIT margin of 24.2%

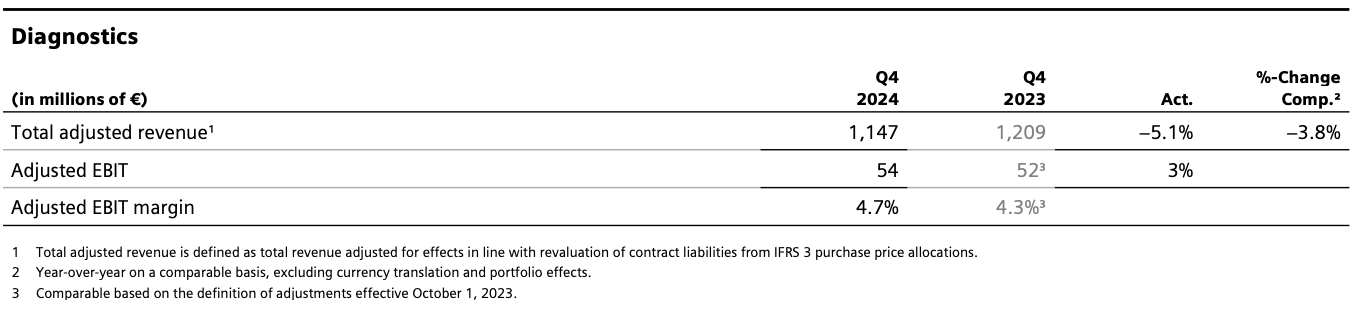

· Diagnostics comparable revenue growth of 0.6% without rapid COVID-19 antigen tests; including the rapid antigen-test business, which has ended, comparable revenue declined by 3.8%; adjusted EBIT margin of 4.7% impacted by effects relating to prior periods

· Varian comparable revenue rose 10.5% from an outstanding prior-year quarter; adjusted EBIT margin of 17.1%

· Advanced Therapies comparable revenue growth of 6.8%; very good adjusted EBIT margin of 20.0%

· Overall adjusted EBIT margin of 17.7%, above prior-year quarter

· Free cash flow of €1.2 billion more than doubled from prior-year quarter

· Adjusted basic earnings per share of €0.67

Outlook for Fiscal Year 2025

For fiscal year 2025, we expect comparable revenue growth of between 5% to 6% compared with fiscal year 2024.

We expect adjusted basic earnings per share to be between €2.35 and €2.50.

Bernd Montag, CEO of Siemens Healthineers AG:

»We achieved our targets for the fiscal year with a very good fourth quarter despite the current market weakness in China. This underlines the fundamental strength of our company and the contribution of the entire Healthineers team. We will carry this momentum into the 2025 financial year.«

Business Development Q4

Revenue in the fourth quarter of fiscal year 2024 was around €6.3 billion. Excluding revenue from the rapid COVID-19 antigen-test business, which ended in the prior-year quarter, comparable revenue rose by 6.5%. Including the rapid antigen-test business, revenue grew by 5.6%. The Imaging, Varian and Advanced Therapies segments contributed to this growth.

From a geographical perspective, the Americas region achieved very strong comparable revenue growth. In the Asia Pacific Japan region revenue rose strongly and in the EMEA region, moderately. In the China region, revenue declined by a mid-single-digit percentage due to currently delayed customer orders.

Equipment order intake again clearly exceeded equipment revenue in the fourth quarter, with a very good equipment book-to-bill ratio of 1.12.

Adjusted EBIT was around €1.1 billion in the fourth quarter, an increase of 9% from the prior-year quarter. This resulted in an adjusted EBIT margin of 17.7%, also higher than in the prior-year quarter. Contributions from strong revenue growth more than compensated for negative currency effects as well as the end of earnings contributions from the rapid COVID-19 antigen-test business.

Net income was €624 million, up 15% from the prior-year quarter. The tax rate was 26%.

Adjusted basic earnings per share rose to €0.67 from €0.60 in the prior-year period. This was largely due to increased earnings contributions from the operating business.

Free cash flow reached around €1.2 billion, more than twice as high as in the prior-year quarter.

Excluding the rapid COVID-19 antigen-test business, revenue in the Diagnostics segment increased 0.6% in the fourth quarter on a comparable basis. Including the rapid COVID-19 antigen business, which generated no revenue in the quarter just ended (prior-year quarter: €53 million), revenue declined 3.8% on a comparable basis to €1.1 billion.

Revenue in the segment rose moderately in the Americas region and slightly in the China region. In the EMEA region, revenues declined slightly. The region Asia Pacific Japan posted a sharp decline in revenue on a comparable basis from the prior-year quarter, which benefitted for the last time from contributions from the rapid COVID-19 antigen-test business.

Excluding the rapid COVID-19 antigen-test business, revenue in this region was slightly below that of the prior-year quarter.

The segment’s adjusted EBIT margin of 4.7% was above the prior-year quarter. Effects relating to prior periods had a negative impact. These included an increase in provisions for medical technology industry reimbursements in Italy from previous years. In the year-over-year comparison, the margin was also impacted by the end of contributions from the rapid COVID-19 antigen-test business in the prior year. Cost reductions related to the transformation program, as well as the longer useful life of leased-out laboratory analyzers, had a positive effect.

Outlook

For fiscal year 2025, we expect comparable revenue growth of between 5% and 6% over fiscal year 2024.

Adjusted basic earnings per share are expected in the range of €2.35 to €2.50.

The outlook is based on several assumptions. This includes the expectation that the current macroeconomic environment, including the interest rate level, will remain largely unchanged.

In addition, the outlook is based on assumptions about exchange rate developments, which currently lead to no material currency effect on the expected adjusted basic earnings per share for fiscal year 2025 compared with fiscal year 2024.

Furthermore, this outlook excludes potential portfolio measures. In addition, the outlook is based on the assumption that developments related to the war in Ukraine and conflicts in the Middle East will not have a material impact on our business activities. The outlook is based on the number of shares outstanding at the end of fiscal year 2024. This outlook also excludes charges from legal, tax and regulatory issues and framework conditions.

Source: Siemens Healthineers Achieves Targets for 2024 Fiscal Year with Strong Fourth Quarter

Copyright © 2026 GL events Ruihe (Shanghai) Exhibition Co., Ltd. All Rights Reserved. ( 沪ICP备12004745号-1 )

We deliver the latest IVD news straight to your inbox. Stay in touch with CACLP News.

sign-up for our newsletter today.

To ensure our newsletter hit your inbox, make sure to add @caclp.com to your safe senders list. And, as always, feel free to contact

us with any questions and thanks again for subscribing.

Go back

Go back