Original from: business wire

Bio-Rad Laboratories, Inc. (NYSE: BIO and BIO.B), a global leader in life science research and clinical diagnostics products, today announced financial results for the fourth quarter and full year ended December 31, 2024.

Norman Schwartz, Bio-Rad’s Chairman and Chief Executive Officer, commented: “Bio-Rad demonstrated resilience and adaptability in 2024. While the biopharma headwinds dampened our Life Science segment results, our Clinical Diagnostics business returned to a more normalized growth rate, and our ongoing transformation initiatives and diligent cost management helped improve our gross margins.” Mr. Schwartz continued: “We begin 2025 in a strong position and remain committed to advancing our transformation, margin expansion, commercial excellence, and long-term shareholder value creation. The anticipated acquisition of digital PCR developer Stilla Technologies furthers our planned transformation as it would support our customers’ increasingly diverse range of research and clinical diagnostic applications.”

Financial Results Highlights

Fourth-Quarter 2024 Results

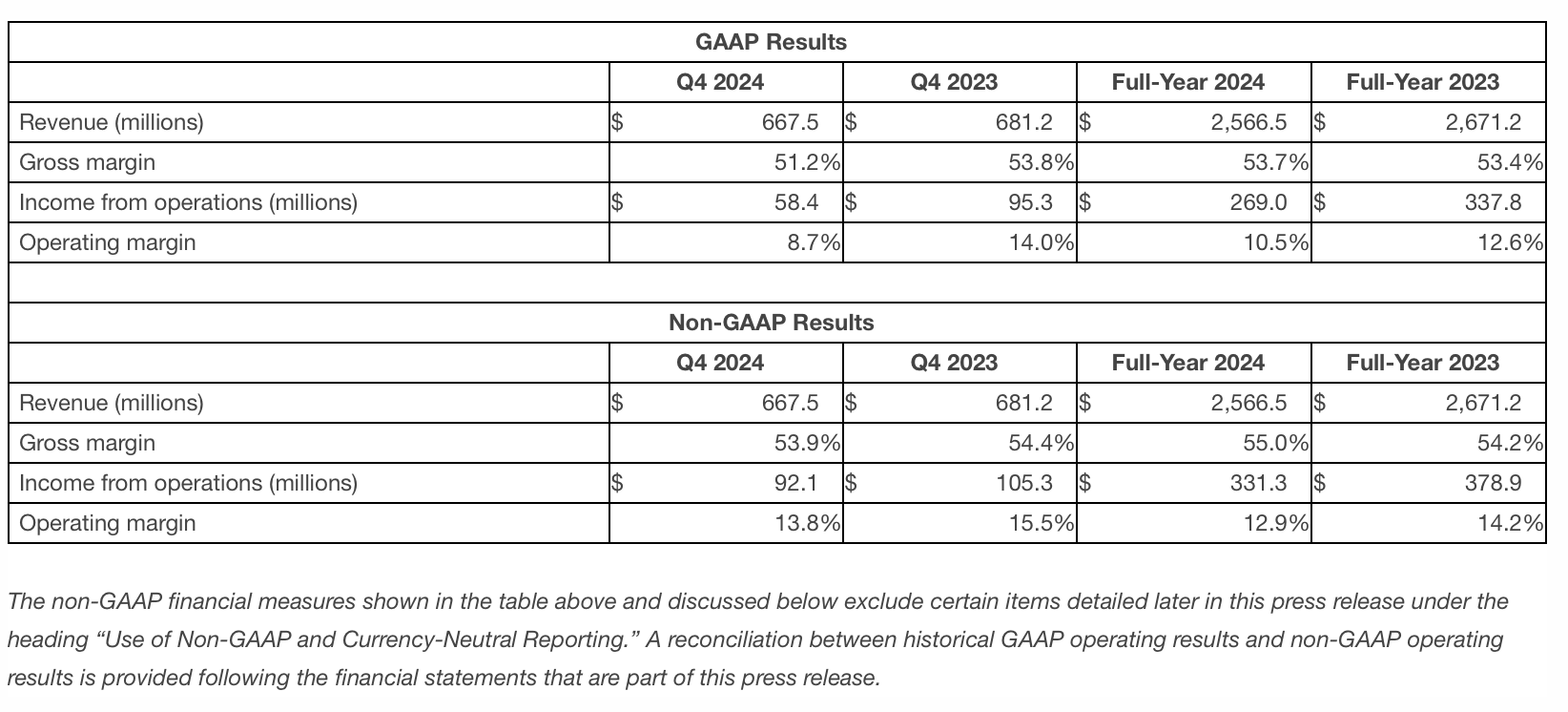

Fourth-quarter 2024 total net sales were $667.5 million, a decrease of 2.0 percent compared to $681.2 million reported for the fourth quarter of 2023. On a currency-neutral basis, quarterly sales decreased 2.3 percent compared to the same period in 2023. The decrease in net sales was driven by lower sales in our Life Science segment.

Life Science segment net sales for the fourth quarter were $275.0 million, a decline of 5.5 percent compared to the same period in 2023. On a currency-neutral basis, Life Science segment sales decreased by 6.0 percent compared to the same quarter in 2023, driven by ongoing weakness in the biotech and biopharma end markets. Currency neutral sales decreased across all regions.

Clinical Diagnostics segment net sales for the fourth quarter were $392.5 million, an increase of 0.9 percent compared to the same period in 2023. On a currency-neutral basis, net sales increased 0.7 percent versus the same quarter last year. The currency neutral sales increase was primarily driven by an increased demand for our quality control and blood typing products. Currency neutral sales increased in EMEA and Americas partially offset by the decrease in Asia Pacific region.

Fourth-quarter gross margin was 51.2 percent compared to 53.8 percent during the fourth quarter of 2023.

Income from operations during the fourth quarter of 2024 was $58.4 million versus $95.3 million during the same quarter last year.

During the fourth quarter of 2024, the company recognized a change in the fair market value of its investment in Sartorius AG, which substantially contributed to a net loss of $715.8 million, or $25.57 per share, on a diluted basis, versus a net income of $349.7 million, or $12.14 per share, on a diluted basis, reported for the same period of 2023.

The effective tax rate for the fourth quarter of 2024 was 21.2 percent, compared to 18.4 percent for the same period in 2023. The effective tax rate reported in these periods was primarily affected by the accounting treatment of our equity securities.

Non-GAAP gross margin was 53.9 percent for the fourth quarter of 2024 compared to 54.4 percent during the fourth quarter of 2023.

Non-GAAP income from operations during the fourth quarter of 2024 was $92.1 million versus $105.3 million during the comparable prior-year period.

Non-GAAP net income for the fourth quarter of 2024 was $81.2 million, or $2.90 per share, on a diluted basis, compared to $89.3 million, or $3.10 per share, on a diluted basis, during the same period in 2023.

The non-GAAP effective tax rate for the fourth quarter of 2024 was 20.9 percent, compared to 22.3 percent for the same period in 2023. The lower rate in 2024 was driven by geographical mix of earnings.

Full-Year 2024 Results

On a reported basis, net sales for the full year of 2024 decreased 3.9 percent to $2,566.5 million compared to $2,671.2 million for the prior year. On a currency-neutral basis, full-year 2024 revenue decreased 3.6 percent year-over-year. The decrease in sales was driven by lower sales in our Life Science segment.

Full-year 2024 reported net sales for the Life Science segment were $1,028.1 million, a decrease of 12.6 percent compared to the prior year on a currency-neutral basis, primarily due to ongoing weakness in the biotech and biopharma end-markets.

Full-year 2024 reported net sales for the Clinical Diagnostics segment were $1,537.9 million, an increase of 3.7 percent compared to the prior year on a currency-neutral basis driven by an increased demand for our quality control and blood typing products.

Full-year 2024 gross margin was 53.7 percent, compared to 53.4 percent in 2023.

Full-year 2024 income from operations was $269.0 million versus $337.8 million in 2023.

During the year of 2024, the company recognized a change in the fair market value of its investment in Sartorius AG, which substantially contributed to a net loss of 1,844.2 million, or $65.36 per share, on a diluted basis, versus a net loss of $637.3 million, or $21.82 per share, on a diluted basis, reported in 2023.

The effective tax rate for the full year of 2024 was 21.3 percent compared to 25.0 percent in 2023. The lower rate in 2024 was primarily driven by geographic mix of earnings.

The non-GAAP financial measures discussed below exclude certain items detailed later in this press release under the heading “Use of Non-GAAP and Currency-Neutral Reporting.” A reconciliation between historical GAAP operating results and non-GAAP operating results is provided following the financial statements that are part of this press release.

Non-GAAP gross margin was 55.0 percent for full-year 2024 compared to 54.2 percent for full-year 2023.

Non-GAAP income from operations for the full year of 2024 was $331.3 million versus $378.9 million for the full year of 2023.

Non-GAAP net income for 2024 was $291.1 million, or $10.31 per share, compared to $345.2 million, or $11.78 per share in 2023.

The non-GAAP effective tax rate for the full year of 2024 was 23.6 percent compared to 22.3 percent in 2023.

Full-Year 2024 Business Segment Highlights

· Continued to drive product innovation, made investments, and formed strategic partnerships to further expand Bio-Rad’s Droplet Digital™ PCR platform into life science research and clinical diagnostics:

- Invested in Geneoscopy to support launch of their FDA-approved, non-invasive colorectal cancer screening test that utilizes our Droplet Digital PCR platform,

- Invested in Oncocyte to commercialize the company’s transplant monitoring assays deploying our QX600™ Droplet Digital PCR system to offer laboratory customers a highly sensitive alternative to centralized sequencing test providers,

- Expanded library of assays for use with Droplet Digital PCR to advance early diagnosis and monitoring of cancers, cell and gene therapy manufacturing, and food safety monitoring,

- Partnered with Allegheny Health Network of hospitals to generate clinical evidence across various cancer types using our Droplet Digital PCR technology for minimal residual disease monitoring of solid tumor cancer patients after treatment,

· As part of Bio-Rad’s product development strategy in cell biology, acquired Saber Bio, a development-stage platform using droplet technology for high-throughput discovery of novel antibodies and T-cell receptors, which play crucial role in identifying potential therapeutic drug candidates,

· On February 13, 2025, announced intent to acquire next-generation digital PCR developer Stilla Technologies, a highly complementary potential addition to Bio-Rad’s digital PCR product portfolio to support our customers’ increasingly diverse range of applications including liquid biopsy for oncology diagnostics, cell and gene therapy, organ transplant testing, infectious diseases, and food and environmental testing; subject notably to proper consultation process, the transaction would be expected to close by the end of the third quarter of 2025.

Full-Year 2025 Financial Outlook

Bio-Rad is providing its financial outlook for the full year 2025. The company currently expects non-GAAP, currency-neutral revenue growth of approximately 1.5 to 3.5 percent and an estimated non-GAAP operating margin of approximately 13.0 to 13.5 percent.

Source: Bio-Rad Reports Fourth-Quarter and Full-Year 2024 Financial Results

Copyright © 2026 GL events Ruihe (Shanghai) Exhibition Co., Ltd. All Rights Reserved. ( 沪ICP备12004745号-1 )

We deliver the latest IVD news straight to your inbox. Stay in touch with CACLP News.

sign-up for our newsletter today.

To ensure our newsletter hit your inbox, make sure to add @caclp.com to your safe senders list. And, as always, feel free to contact

us with any questions and thanks again for subscribing.

Go back

Go back