Original from: Abbott

Abbott (NYSE: ABT) today announced financial results for the third quarter ended Sept. 30, 2025.

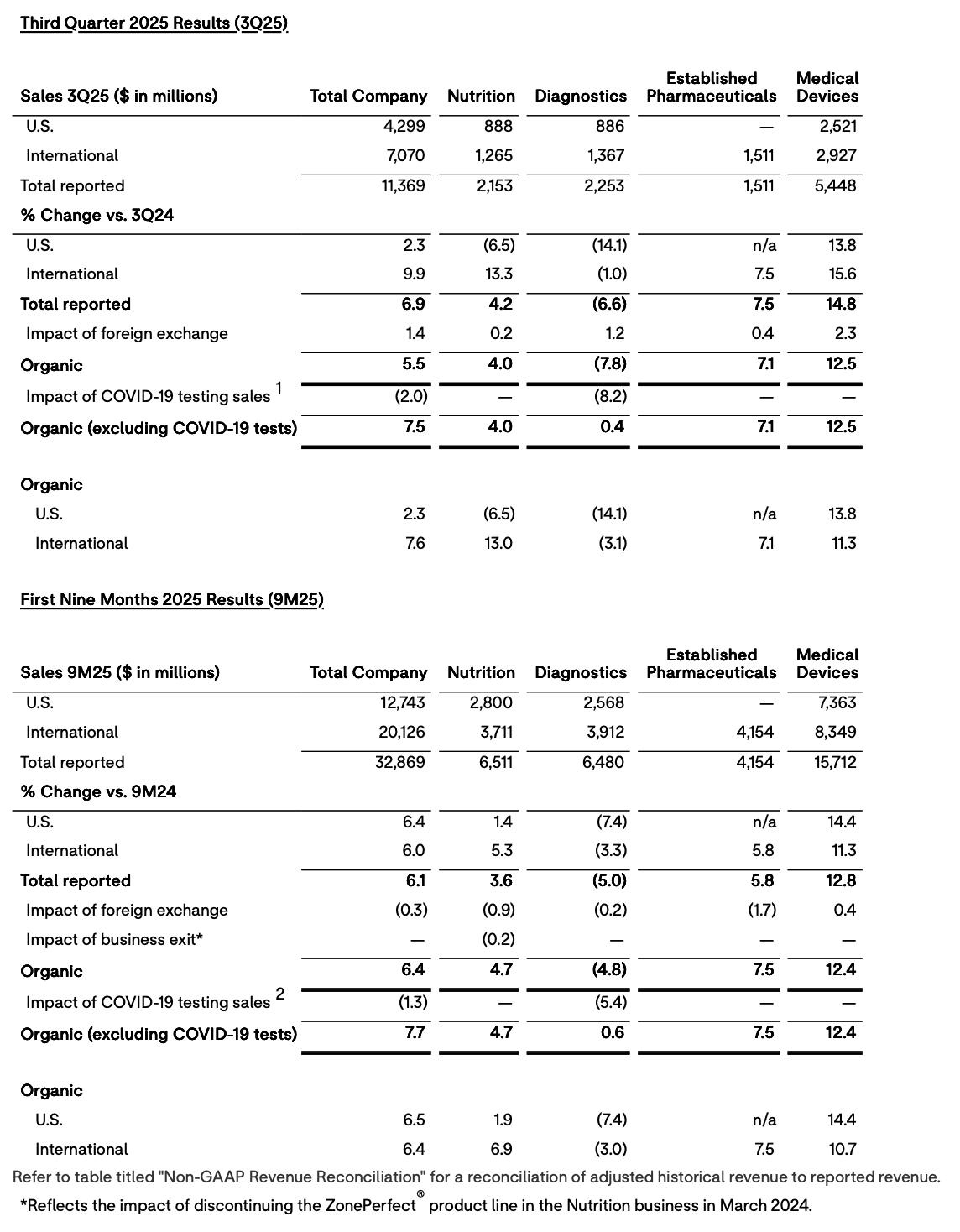

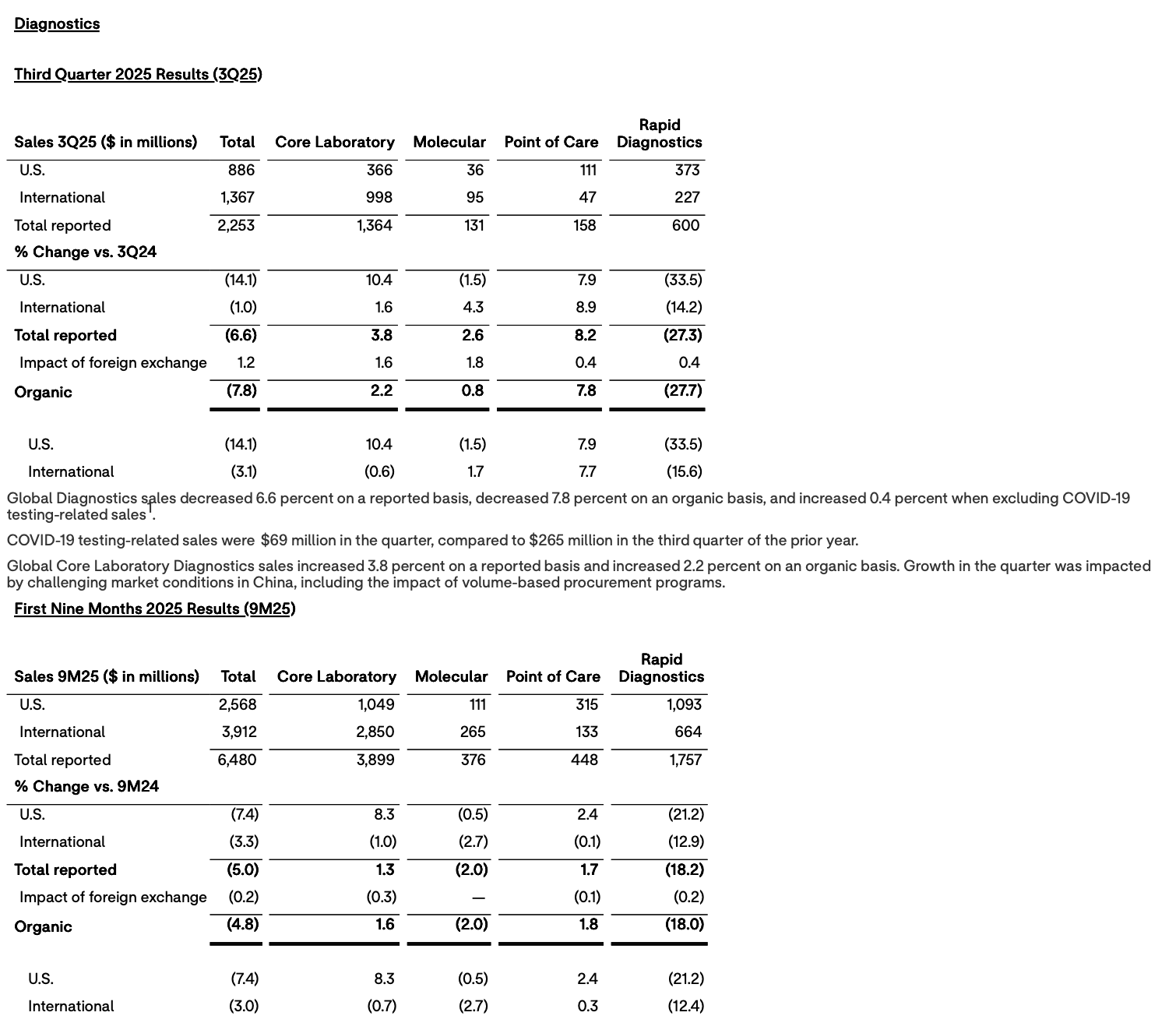

· Third-quarter sales increased 6.9 percent on a reported basis, 5.5 percent on an organic basis, or 7.5 percent when excluding COVID-19 testing-related sales1.

· Third-quarter GAAP diluted EPS of $0.94 and adjusted diluted EPS of $1.30, which excludes specified items.

· Year-to-date sales increased 6.1 percent on a reported basis, 6.4 percent on an organic basis, or 7.7 percent when excluding COVID-19 testing-related sales2.

· Abbott reaffirms previously provided full-year 2025 organic sales growth guidance.

· Abbott reaffirms the midpoint of previously provided full-year 2025 adjusted diluted EPS guidance range and narrows the range to $5.12 to $5.18, reflecting double-digit growth at the midpoint.

· In July, Abbott announced it received regulatory approval in Japan for TriClip®, a first of-its-kind, minimally invasive treatment option for patients with tricuspid regurgitation, or a leaky tricuspid heart valve.

· In August, Abbott announced it received CE Mark for an expanded indication for the company's Navitor® transcatheter aortic valve implantation (TAVI) system to treat people with symptomatic, severe aortic stenosis who are at low or intermediate risk for open-heart surgery.

· In August, at the European Society of Cardiology (ESC) Congress, new treatment guidelines were issued that provide additional support for the use of MitraClip® and TriClip in treating valvular heart disease. These new guidelines were backed by evidence from multiple clinical studies.

"Our third-quarter results demonstrate our ability to deliver consistent, high-quality performance," said Robert B. Ford, chairman and chief executive officer, Abbott. "Our differentiated product pipeline continues to power our performance and positions Abbott to deliver durable long-term value to our shareholders."

THIRD-QUARTER BUSINESS OVERVIEW

Management believes that measuring sales growth rates on an organic basis, which excludes the impact of foreign exchange and the impact of discontinuing the ZonePerfect® product line in the Nutrition business, is an appropriate way for investors to best understand the core underlying performance of the business. Management further believes that measuring sales growth rates on an organic basis excluding COVID-19 tests is an appropriate way for investors to best understand the underlying performance of the company as the demand for COVID-19 tests has significantly declined following the transition from a pandemic to endemic phase.

Note: In order to compute results excluding the impact of exchange rates, current year U.S. dollar sales are multiplied or divided, as appropriate, by the current year average foreign exchange rates and then those amounts are multiplied or divided, as appropriate, by the prior year average foreign exchange rates.

ABBOTT'S FINANCIAL GUIDANCE

Abbott reaffirms previously provided full-year 2025 organic sales growth guidance of 7.5% to 8.0%, excluding COVID-19 testing-related sales, or 6.0% to 7.0%, when including COVID-19 testing-related sales. Abbott also reaffirms the midpoint of the previously provided full-year 2025 adjusted diluted EPS guidance range and narrows the range to $5.12 to $5.18, which reflects double-digit growth at the midpoint.

Abbott has not provided the related GAAP financial measures on a forward-looking basis for these forward-looking non-GAAP financial measures because the company is unable to predict with reasonable certainty and without unreasonable effort the timing and impact of certain items such as restructuring and cost reduction initiatives, charges for intangible asset impairments, acquisition-related expenses, and foreign exchange, which could significantly impact Abbott's results in accordance with GAAP.

Source: Abbott Reports Third-Quarter 2025 Results And Reaffirms Full-Year Guidance

Copyright © 2026 GL events Ruihe (Shanghai) Exhibition Co., Ltd. All Rights Reserved. ( 沪ICP备12004745号-1 )

We deliver the latest IVD news straight to your inbox. Stay in touch with CACLP News.

sign-up for our newsletter today.

To ensure our newsletter hit your inbox, make sure to add @caclp.com to your safe senders list. And, as always, feel free to contact

us with any questions and thanks again for subscribing.

Go back

Go back