Original from: Roche

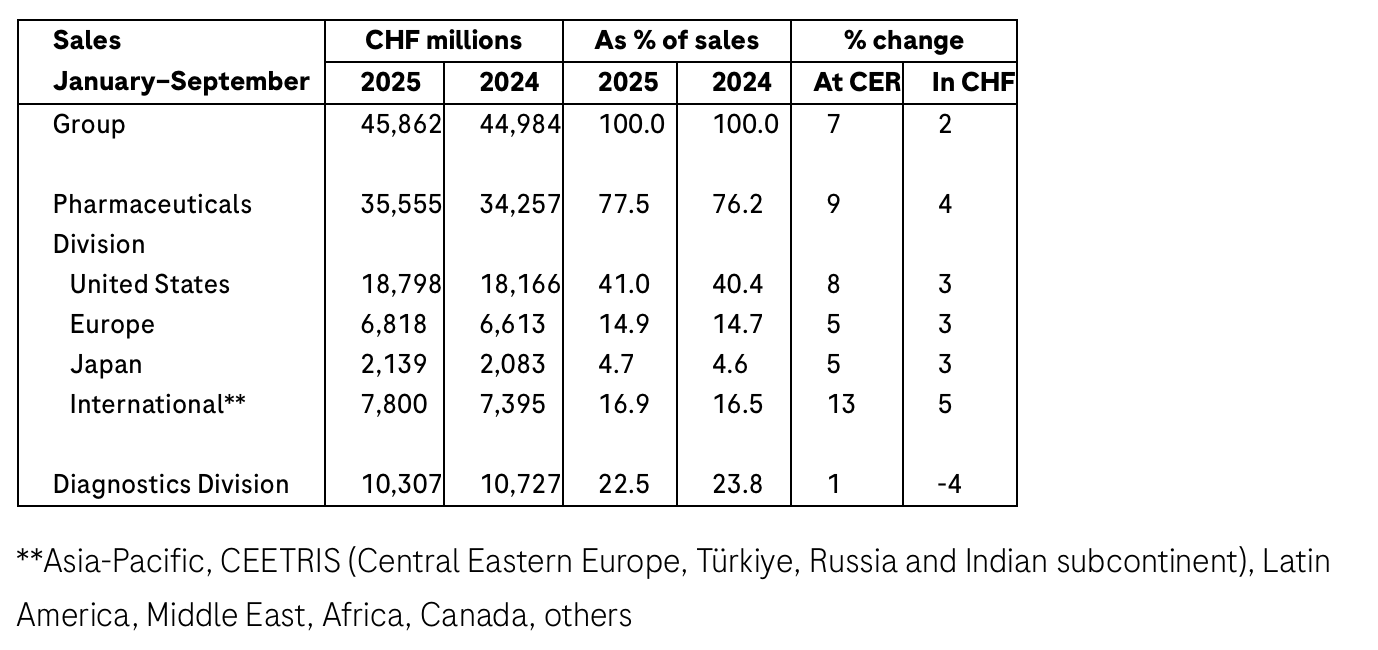

· Group sales grew by 7% at constant exchange rates (CER; 2% in CHF) in the first nine months, driven by high demand for our innovative medicines and diagnostics.

· Pharmaceuticals Division sales rose by 9% (4% in CHF) due to continued high growth in sales of medicines for the treatment of severe diseases; Phesgo (breast cancer), Xolair (food allergies), Hemlibra (haemophilia A), Vabysmo (serious eye diseases) and Ocrevus (multiple sclerosis) were the top growth drivers.

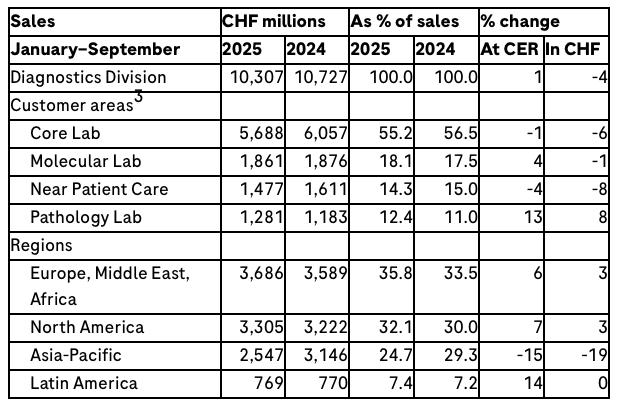

· Diagnostics Division sales increased by 1% (-4% in CHF) as demand for pathology solutions and molecular diagnostics more than offset the impact of healthcare pricing reforms in China.

· Highlights:

- US approval for Tecentriq combination for a form of lung cancer and Gazyva/Gazyvaro for a severe kidney disease

- EU CE mark for Contivue, a port delivery platform with Susvimo*, for a severe eye disease

- Positive EU CHMP recommendation for the subcutaneous formulation of Lunsumio for a type of blood cancer and for Gazyva/Gazyvaro for a severe kidney disease

- Positive data from phase III study on giredestrant in breast cancer, phase II open-label extension study on fenebrutinib in multiple sclerosis, phase I/II study on trontinemab in Alzheimer’s disease and long-term follow-up studies on Vabysmo and Susvimo in a severe age-related eye disease

- Advancement of several key drug candidates into phase III trials: zilebesiran for uncontrolled hypertension, CT-388 for obesity, CT-868 for type 1 diabetes, cevostamab for a difficult-to-treat form of blood cancer and ZN-1041 for a type of breast cancer

- Announcement of a merger agreement to acquire 89bio and its phase III FGF21 analogue for the treatment of moderate to severe metabolic dysfunction-associated steatohepatitis (MASH), a form of fatty liver disease that is one of the most prevalent comorbidities of obesity

- EU CE mark and US approval for the Elecsys pTau181, the only FDA-cleared blood test for use in primary care to rule out Alzheimer’s disease-related amyloid pathology

- EU CE mark for the first AI-based risk stratification tool to assess progressive decline in kidney function and for the sixth-generation Troponin T test, which shows a new level of accuracy critical in diagnosing heart attacks

· Outlook for 2025 earnings raised.

Roche CEO Thomas Schinecker: “We continue to build on our positive momentum with strong sales growth of 7% at constant exchange rates.

Our momentum is further reflected in our pipeline with a number of positive clinical read-outs and a record ten potentially transformative medicines progressing into the final phase of development for diseases with significant unmet need. By the end of the decade, we expect phase III clinical results for up to 19 new medicines.

Our groundbreaking next-generation sequencing technology, set to launch next year, has achieved a new record for decoding a whole human genome in under four hours.

Based on our strong results, we are raising our earnings outlook for the full year.”

Outlook for 2025 earnings raised

Roche (SIX: RO, ROG; OTCQX: RHHBY) expects an increase in Group sales in the mid single digit range (CER). Core earnings per share are targeted to develop in the high single to low double digit range (CER). Roche expects to further increase its dividend in Swiss francs.

Group sales

In the first nine months of 2025, Roche achieved sales growth of 7% (2% in CHF) to CHF 45.9 billion due to strong demand for our pharmaceutical and diagnostic products.

The appreciation of the Swiss franc against most currencies, notably the US dollar, had an adverse impact on sales when reported in Swiss francs compared to constant exchange rates.

Sales in the Pharmaceuticals Division increased by 9% (4% in CHF) to CHF 35.6 billion, with medicines for severe diseases continuing their strong growth.

The top five growth drivers – Phesgo, Xolair, Hemlibra, Vabysmo and Ocrevus – achieved total sales of CHF 15.8 billion. This represents an increase of CHF 2.4 billion at CER compared to the first nine months of 2024.

This increase more than compensated for the total decrease of CHF 0.5 billion (CER) in sales of the ‘loss of exclusivity (LOE)’ products – the decline in sales of Avastin (various types of cancer), Herceptin (breast and gastric cancer), MabThera/Rituxan (blood cancer, rheumatoid arthritis), Lucentis (severe eye diseases) and Esbriet (lung disease) was partially offset by an increase in sales of Actemra/RoActemra (rheumatoid arthritis).

In the United States, sales rose by 8% due to growth in sales of Xolair, Phesgo, Ocrevus, Hemlibra, Polivy (blood cancer) and Vabysmo. This growth more than compensated for the decline in sales of medicines with expired patents.

Sales in Europe grew 5% as strong demand for Ocrevus and Vabysmo and the continuing uptake of Polivy, Phesgo and Hemlibra more than compensated for the lower sales of Perjeta (breast cancer) due to ongoing conversion of patients to Phesgo and the impact of biosimilar competition on Actemra/RoActemra sales.

In Japan, sales increased by 5%, mainly due to the strong uptake of Phesgo, Hemlibra, Vabysmo and PiaSky (paroxysmal nocturnal haemoglobinuria). Sales growth was partially offset by the decline in sales of Perjeta due to continued conversion of patients to Phesgo and of Avastin because of biosimilar erosion.

Sales in the International region grew by 13%, led by Phesgo, Hemlibra, Vabysmo, Xofluza (influenza) and Kadcyla (breast cancer). In China, sales rose by 9%, driven by the uptake of Phesgo due to inclusion in the government drug reimbursement list, strong sales of Xofluza and the continued roll-out of Polivy and Vabysmo.

The Diagnostics Division’s sales increased by 1% (-4% in CHF) to CHF 10.3 billion as growth in demand for pathology solutions and molecular diagnostics more than offset the impact of healthcare pricing reforms in China.

Sales in the Europe, Middle East and Africa (EMEA) region increased by 6%, driven by higher sales of clinical chemistry and immunodiagnostic products. In North America, sales increased by 7%, with growth across customer areas. Sales in Asia-Pacific decreased by 15% due to healthcare pricing reforms in China. Latin America sales grew by 14%.

Diagnostics: key developments

Diagnostics sales

Copyright © 2026 GL events Ruihe (Shanghai) Exhibition Co., Ltd. All Rights Reserved. ( 沪ICP备12004745号-1 )

We deliver the latest IVD news straight to your inbox. Stay in touch with CACLP News.

sign-up for our newsletter today.

To ensure our newsletter hit your inbox, make sure to add @caclp.com to your safe senders list. And, as always, feel free to contact

us with any questions and thanks again for subscribing.

Go back

Go back