Original from: Bio-Rad

Bio-Rad Laboratories, Inc. (NYSE: BIO and BIO.B), a global leader in life science research and clinical diagnostics products, today announced financial results for the third quarter ended September 30, 2025.

“During the third quarter, we continued to navigate a dynamic global environment and evolving conditions across the markets for our life science and clinical diagnostics products," stated Norman Schwartz, Bio-Rad's Chairman and CEO. "Despite ongoing challenges in academic research and biotech funding, and the resulting reduced demand for instruments, our teams delivered solid results in Q3. Our ongoing focus on disciplined cost management contributed to a better-than-expected operating margin."

Financial Results Highlights

Third-Quarter 2025 Results

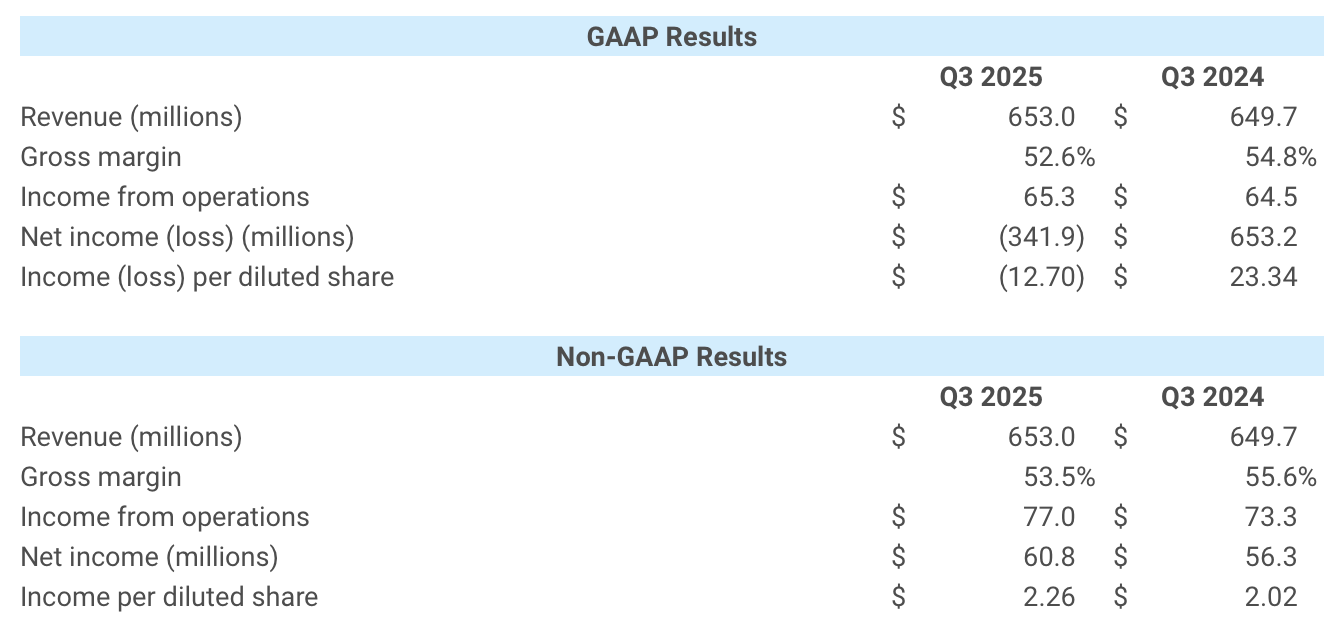

Third-quarter 2025 total net sales were $653.0 million, an increase of 0.5 percent compared to $649.7 million reported for the third quarter of 2024. On a currency-neutral basis, quarterly sales decreased 1.7 percent compared to the same period in 2024, primarily due to lower sales in both Life Science and Clinical Diagnostics segments.

Life Science Group net sales for the third quarter were $261.8 million, an increase of 0.3 percent compared to the same period in 2024. On a currency-neutral basis, Life Science segment sales decreased by 1.5 percent compared to the same quarter in 2024. The currency-neutral year-over-year sales decrease was driven by the constrained academic research and biotech funding environment.

Clinical Diagnostics Group net sales for the third quarter were $391.2 million, an increase of 0.6% compared to the same period in 2024. On a currency-neutral basis, net sales decreased 1.8 percent versus the same quarter last year. The currency-neutral year-over-year sales decrease was primarily driven by lower reimbursement rates for diabetes testing in China.

During the third quarter of 2025, the company recognized a change in the fair market value of its investment in Sartorius AG, which substantially contributed to a net loss of $(341.9) million, or $(12.70) per share, on a diluted basis, versus net income of $653.2 million, or $23.34 per share, on a diluted basis, reported for the same period of 2024.

Non-GAAP net income for the third quarter of 2025 was $60.8 million, or $2.26 per share, on a diluted basis, compared to $56.3 million, or $2.02 per share, on a diluted basis, during the same period in 2024.

The effective tax rate for the third quarter of 2025 was 20.7 percent, compared to 24.2 percent for the same period in 2024. The effective tax rate reported in these periods was primarily impacted by the accounting treatment of our equity securities.

The non-GAAP effective tax rate for the third quarter of 2025 was 26.7 percent, compared to 28.8 percent for the same period in 2024. The higher rate in 2024 was driven by geographical mix of earnings and valuation of our deferred tax assets.

Full-Year 2025 Financial Outlook

Bio-Rad is maintaining its financial outlook for the full year 2025. The company continues to expect non-GAAP, currency-neutral revenue growth of approximately 0 to 1.0 percent and a non-GAAP operating margin of approximately 12.0 to 13.0 percent.

Source: Bio-Rad Reports Third-Quarter 2025 Financial Results

Copyright © 2026 GL events Ruihe (Shanghai) Exhibition Co., Ltd. All Rights Reserved. ( 沪ICP备12004745号-1 )

We deliver the latest IVD news straight to your inbox. Stay in touch with CACLP News.

sign-up for our newsletter today.

To ensure our newsletter hit your inbox, make sure to add @caclp.com to your safe senders list. And, as always, feel free to contact

us with any questions and thanks again for subscribing.

Go back

Go back