Original from: QuidelOrtho

Third Quarter 2025 Results

(all comparisons are to the prior year period)

· Total revenue was $700 million, as reported

- Non-respiratory revenue was $588 million, an increase of 5% as reported and 4% in constant currency; excluding Donor Screening1, non-respiratory revenue grew 6% in constant currency

- Labs revenue grew 5% as reported and 4% in constant currency

- Respiratory revenue was $112 million as reported; the decline was primarily driven by a 63% decrease in COVID-19 revenue

· GAAP operating expenses2 decreased by 6%; non-GAAP operating expenses decreased by 7%, both driven by the Company's cost-savings initiatives

· GAAP net loss margin was (105%); GAAP operating margin was (101%), which included a $701 million non-cash goodwill impairment charge (see description below); adjusted EBITDA margin was 25%, a 180 basis point improvement compared to the prior year period

· GAAP diluted loss per share was $10.78; adjusted diluted earnings per share ("EPS") was $0.80

QuidelOrtho Corporation (Nasdaq: QDEL) (the "Company" or "QuidelOrtho"), a global leader of innovative in vitro diagnostics, today announced financial results for the third quarter ended September 28, 2025.

"Our third quarter results reflect continued execution and meaningful progress against our strategic and financial priorities," said Brian J. Blaser, President and Chief Executive Officer of QuidelOrtho. "Through disciplined execution and focused investments in our highest-growth areas, we are expanding margins and accelerating innovation—most recently with the addition of high-sensitivity Troponin on our VITROS platform. Backed by a broad portfolio, global reach, and operational focus, we believe we are well positioned to deliver sustainable growth and long-term value for our shareholders."

Third Quarter 2025

The Company reported total revenue for the third quarter of 2025 of $700 million, compared to $727 million in the prior year period, a 4% decrease as reported. The decrease in total revenue was primarily due to lower COVID-19 and Donor Screening revenue compared to the prior year period. Foreign currency translation had a favorable impact of approximately 90 basis points on the Company's third quarter 2025 revenue.

GAAP diluted loss per share for the third quarter of 2025 was $10.78, compared to diluted loss per share of $0.30in the prior year period. GAAP net loss for the third quarter of 2025 was $733 million, compared to $20 million in the prior year period. GAAP operating loss for the third quarter of 2025 was $705 million, compared to an operating income of $15 million in the prior year period. GAAP net loss and GAAP operating loss in the third quarter of 2025 included a non-cash goodwill impairment charge of $701 million due to a decrease in the estimated fair value related to the decline in the Company's stock price and market capitalization. As a result, GAAP net loss margin was (105%), compared to (3%) in the prior year period, and GAAP operating margin was (101%), compared to 2% in the prior year period. Third quarter 2025 results included $40 million in restructuring, integration and other charges.

Adjusted diluted EPS for the third quarter of 2025 was $0.80, compared to adjusted diluted EPS of $0.85 in the prior year period. Adjusted EBITDA for the third quarter of 2025 was $177 million, compared to $171 million in the prior year period. Adjusted EBITDA margin for the third quarter of 2025 was 25%, compared to 23% in the prior year period. The year-over-year increase was driven by the Company's cost-savings initiatives.

|

1 The Company is in the process of winding down its U.S. Donor Screening portfolio. |

|

2 Operating expenses is comprised of Selling, marketing and administrative and Research and development expenses. |

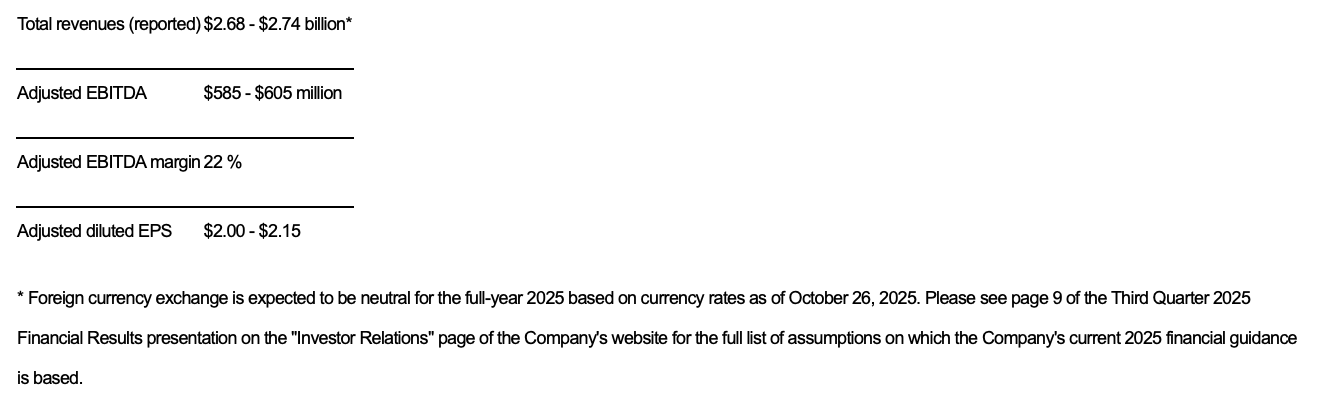

Full-year 2025 Financial Guidance

Based on its current business outlook, the Company is providing its fiscal 2025 financial guidance, as follows:

A reconciliation of forward-looking non-GAAP measures, including adjusted EBITDA, adjusted EBITDA margin and adjusted diluted EPS, to the most directly comparable GAAP measures is not provided because comparable GAAP measures for such measures are not reasonably accessible or reliable due to the inherent difficulty in forecasting and quantifying measures that would be necessary for such reconciliation. We are not, without unreasonable effort, able to reliably predict the impact of impairment charges and related tax benefits, employee compensation costs and other adjustments. These items are uncertain, depend on various factors and may have a material impact on our future GAAP results. In addition, the Company believes any such reconciliation would imply a degree of precision and certainty that could be confusing to investors. See "Forward-Looking Statements" and "Non-GAAP Financial Measures."

Source: QuidelOrtho Reports Third Quarter 2025 Financial Results

Copyright © 2026 GL events Ruihe (Shanghai) Exhibition Co., Ltd. All Rights Reserved. ( 沪ICP备12004745号-1 )

We deliver the latest IVD news straight to your inbox. Stay in touch with CACLP News.

sign-up for our newsletter today.

To ensure our newsletter hit your inbox, make sure to add @caclp.com to your safe senders list. And, as always, feel free to contact

us with any questions and thanks again for subscribing.

Go back

Go back