Original from: Diasorin

The Board of Directors of Diasorin S.p.A. (FTSE MIB: DIA), examined and approved the Group’s Consolidated Financial Statements as of September 30, 2025.

COMMENTS ON ECONOMIC RESULTS

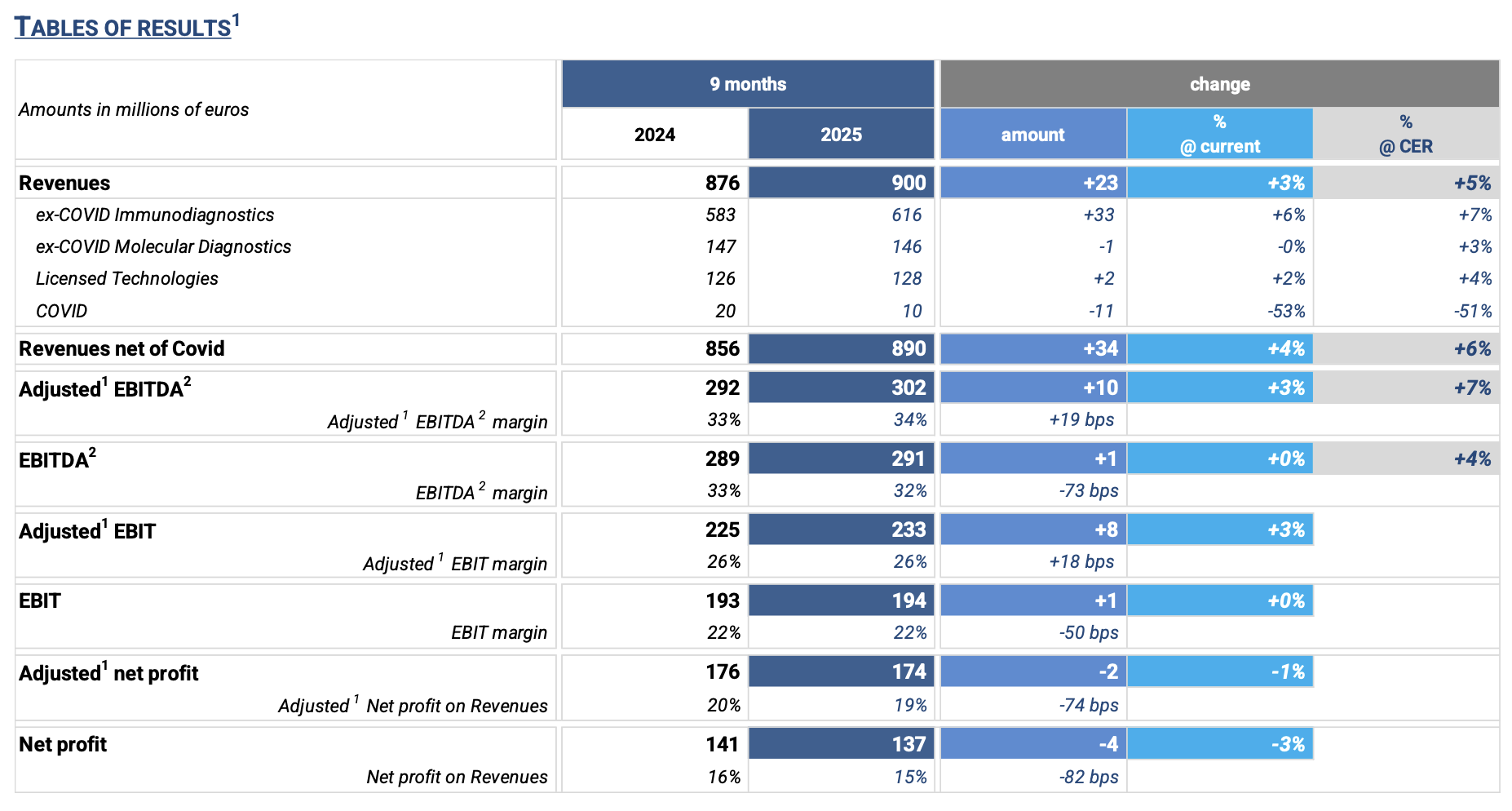

REVENUES: € 900 million in 9M’25, +3% (+5% at CER) compared to the same period in 2024. Excluding the COVID business, revenues grew +6% at CER.

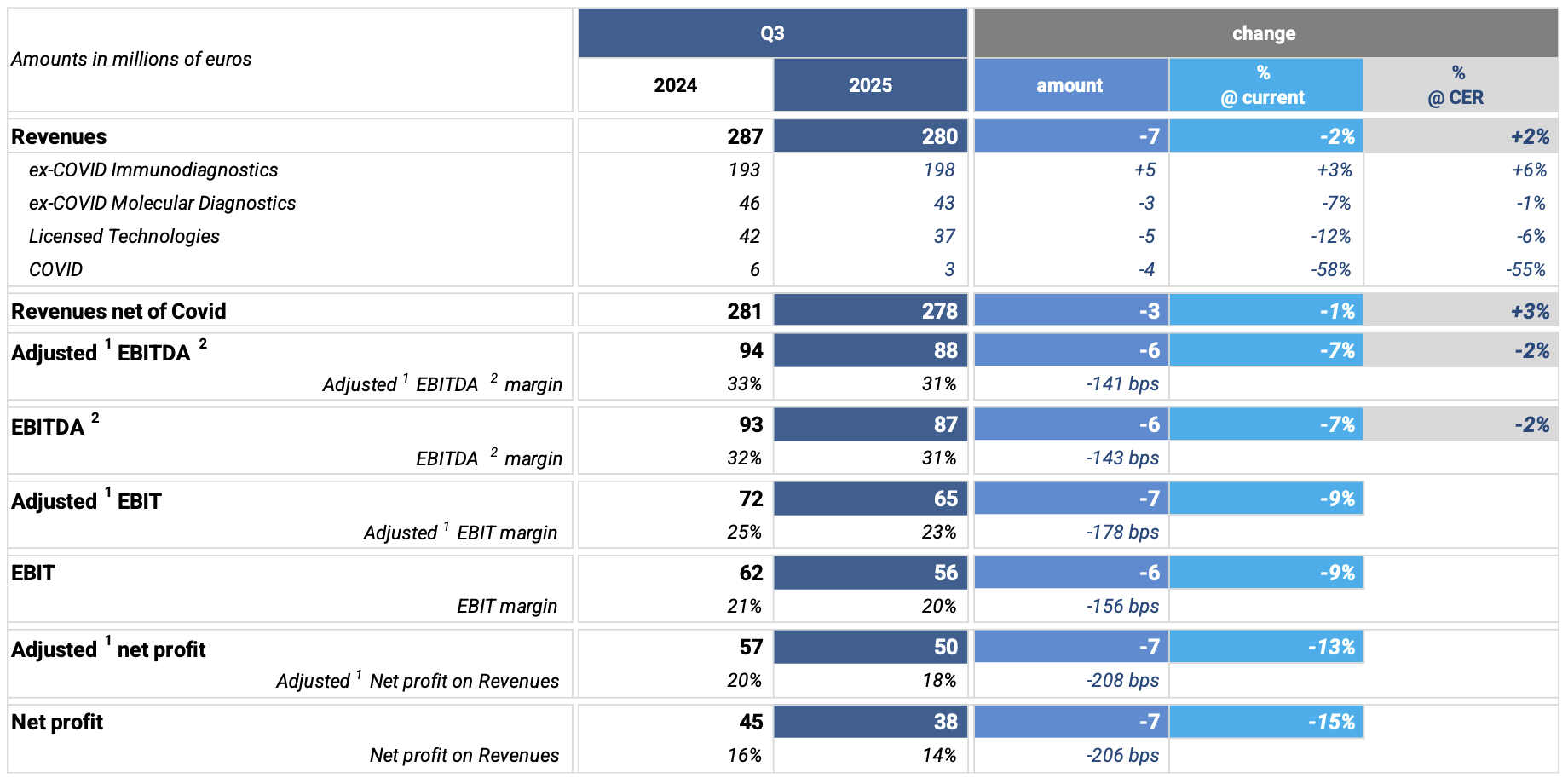

In Q3’25, revenue variation was -2% (+2% at CER), driven by the following factors:

· Significant depreciation of the US Dollar against the Euro, impacting Q3’25 by approximately € 12 million;

· Contraction of the Chinese market due to Volume-Based Procurement (VBP) regulations, which continue to negatively affect the performance of the entire diagnostics sector;

· Expected decline in COVID-related sales;

· Timing of LTG business revenues which, despite confirming growth over the first 9 months, in Q3’25 recorded a 6% decline at CER;

· Moderate sales volumes of molecular tests for respiratory infections.

At CER and excluding the COVID business, Q3’25 revenues grew by +3%, thanks to the strong performance of the immunodiagnostics business and excellent sales of specialty tests on the lowplex molecular diagnostic platform LIAISON MDX®.

The following is the revenue performance by business line:

· Immunodiagnostics ex-COVID: € 616 million in 9M’25, up € 33 million, +6% (+7% at CER) compared to the same period in 2024, driven by strong CLIA specialty test sales.

Q3’25 registered +3% growth (+6% at CER) supported by the U.S. Hospital Strategy, which is performing in line with the target of achieving 600 hospitals in the U.S. by 2027, as well as by increased sales in the European market. Despite lower-than-expected organic volume growth in some countries and compared to previous quarters, these results offset the unfavorable comparison with 2024 outbreak-driven volumes and the effects from the Chinese market which are impacting the performance of all companies operating in the diagnostic segment.

Excluding these two effects, this business line grew +10% at CER in the first 9M’25.

· Molecular Diagnostics ex-COVID: € 146 million in 9M’25, flat at current exchange rates (+3% at CER) compared to the same period in 2024, due to:

- Double-digit growth in specialty test sales on the lowplex LIAISON MDX® platform, as well as in panel sales currently available on the automated multiplexing platforms (Verigene I and LIAISON PLEX®);

- Decline in respiratory panel sales on lowplex LIAISON MDX® and non-automated multiplexing platforms;

- Discontinuation of the Aries platform.

In Q3’25, sales declined -7% (-1% at CER), due to:

- Strong performance of specialty tests on LIAISON MDX® (ca. +40% at CER), offsetting the overall weakening of the respiratory segment due to the limited test volumes associated with the flu season;

- Growth of automated multiplexing platforms (Verigene I & LIAISON PLEX®), equal to +3% at CER, driven by modest contributions from seasonal viral infection tests;

- Unfavorable comparison with Q3’24 due to Aries lowplex platform discontinuation, as well as the absence of outbreak-driven revenue contributions.

Excluding the effects of the Aries platform and of the outbreaks, molecular diagnostics ex-COVID revenues grew +2% at CER in Q3’25 and +7% at CER in 9M’25.

· Licensed Technologies: € 128 million in 9M’25, +2% (+4% at CER) compared to the same period in 2024. Strong performance in the Diagnostics segment was partially offset by lower Life Science segment sales, in line with broader market trends.

Q3’25 (-12% at current exchange rates; -6% at CER) was impacted by unfavorable timing of key orders that had boosted revenues earlier in the first months of 2025.

· COVID: € 10 million in 9M’25, -53% (-51% at CER), declining as expected compared to 9M’24.

The following is the revenue performance by geography excluding COVID contribution:

· Direct North America: € 446 million in 9M’25, +6% (+9% at CER).

Growth was driven by strong immunodiagnostics performance (+12% at current exchange rates; +15% at CER), confirming the success of the hospital strategy and CLIA specialty test offering. Positive performance also noted in the lowplex LIAISON MDX® molecular segment, especially the specialty test segment.

· Direct Europe: € 315 million in 9M’25, +4% at both current and constant exchange rates.

Growth was led by immunodiagnostics, particularly specialty tests which characterize Diasorin’s offering, despite unfavorable comparisons with 9M’24, which benefited from outbreak-driven volume, and reduced organic volume growth in key European countries in Q3’25.

Excluding outbreak impacts, growth was +7%.

· Rest of the World: € 129 million in 9M’25, -4% (flat at CER).

Positive performance in countries served directly or via distributors was offset by revenue contraction in China, mainly due to the implementation of VBP regulation, which is affecting the performance of all companies operating in the diagnostic segment.

Excluding China, the “Rest of the World” area grew +7% at CER.

ADJUSTED1 GROSS PROFIT: € 587 million (65% of revenues), up € 9 million, +2% vs. 9M’24.

ADJUSTED1 EBITDA2: € 302 million (34% of revenues at both current and constant exchange rates), up € 10 million (+3% at current; +7% at CER) vs. 9M’24, with a higher incidence on revenues (33% in the previous year).

The reduction in margin in Q3’25 compared to the same period in 2024 (31% at current exchange rates; 32% at CER) is mainly due to tariff impacts and a different technological and geographical sales mix.

ADJUSTED1 EBIT: € 233 million (26% of revenues), up € 8 million (+3%) vs. 9M’24.

Q3’25 EBIT declined -9% vs. 2024 (23% of revenues), due to US Dollar depreciation, slight margin reduction from unfavorable product/technology mix, tariff impacts, and slightly lower operating leverage.

NET FINANCIAL CHARGES: € 12 million, in line with 9M’24.

TAXES: € 45 million, with a tax rate of 24.5%.

ADJUSTED1 NET PROFIT: €174 million (19% of revenues), down € 2 million (-1%) vs. 9M’24.

COMMENT ON FINANCIAL RESULTS

CONSOLIDATED NET FINANCIAL DEBT: -€ 617 million (-€ 618 million as of December 31, 2024). The € 1 million variation is mainly attributable to strong operating cash generation in 9M’25, offset by dividend payments totaling € 63 million and a € 97 million outlay following the exercise of the withdrawal right by certain shareholders due to the enhanced voting mechanism.

FREE CASH FLOW3: € 161 million as of September 30, 2025 (€ 164 million as of September 30, 2024).

The year-over-year variation is primarily due to higher tax payments in 9M’25, especially in the United States, compared to the same period in 2024, which had benefited from prior-year tax credits. Additionally, following the conversion into law of Legislative Decree No. 95 dated June 30, 2025 (known as the “Economy Decree”), an amount of approximately € 6 million was paid in Italy as a payback related to the years 2015-2018.

BUSINESS HIGHLIGHTS

IMMUNODIAGNOSTICS:

· New evidence presented at ACEP 2025 on the role of MeMed BV in supporting clinical decision-making in emergency medicine;

· Launch of LIAISON TSH-R Ab, a test designed to improve the diagnosis of Graves’ disease, in all CE-mark accepting countries.

MOLECULAR DIAGNOSTICS:

· FDA 510(k) clearance for the SIMPLEXA COVID-19, Flu A/B & RSV Direct test on the LIAISON MDX® platform;

· Commercial agreement with Quest Diagnostics for the use of the innovative LIAISON PLEX® multiplexing molecular platform;

· Submission of the molecular diagnostic Point-of-Care platform LIAISON NES® and its respiratory 4-plex panel (Flu A, Flu B, COVID, RSV) to the U.S. FDA for 510(k) clearance and CLIA Waiver;

· Launch of the full panel portfolio to diagnose bloodstream infections on LIAISON PLEX®, the new multiplexing platform of the Group, following the U.S. FDA 510(k) clearance for the LIAISON PLEX® Gram-Positive Blood Culture Assay,

LIAISON PLEX® Gram-Negative Blood Culture Assay, and LIAISON PLEX® Blood Culture Yeast Assay;

· Launch of a new Measles Virus Primer Pair in the U.S., expanding the growing portfolio of Analyte-Specific Reagents (ASRs);

· Launch of Simplexa™ C. auris direct assay on the LIAISON® MDX platform for all countries accepting the CE Mark.

FY 2025 GUIDANCE AT 2024 CER

The Company revises FY 2025 guidance:

· EX-COVID REVENUES: approx. +5%, approx. +4% including COVID revenues (equal to approx. € 10 million)

· ADJUSTED1 EBITDA2 MARGIN: approx. 33%

Copyright © 2026 GL events Ruihe (Shanghai) Exhibition Co., Ltd. All Rights Reserved. ( 沪ICP备12004745号-1 )

We deliver the latest IVD news straight to your inbox. Stay in touch with CACLP News.

sign-up for our newsletter today.

To ensure our newsletter hit your inbox, make sure to add @caclp.com to your safe senders list. And, as always, feel free to contact

us with any questions and thanks again for subscribing.

Go back

Go back